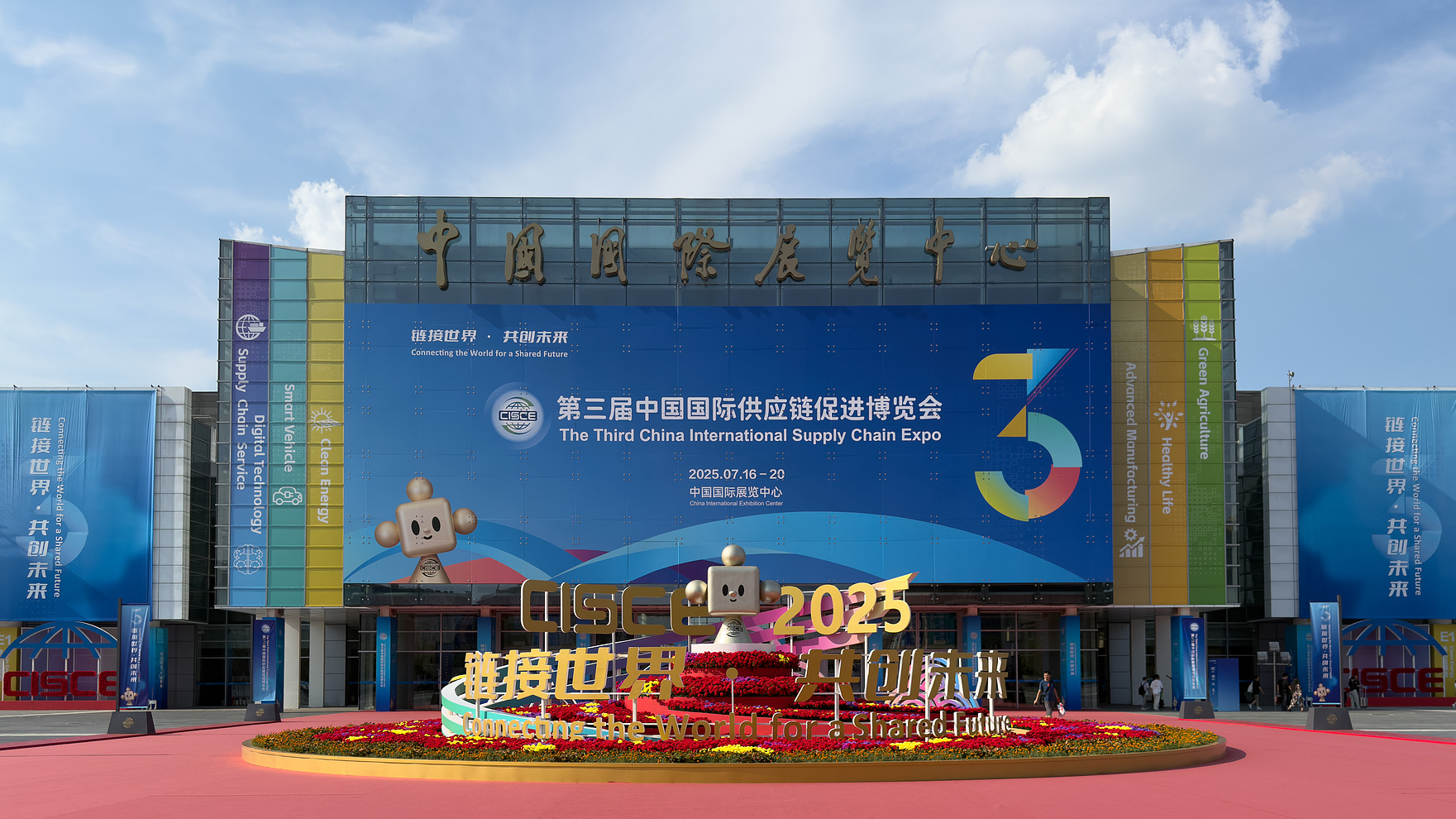

The Third China International Supply Chain Expo opens at the China International Exhibition Center (Shunyi Hall) in Beijing, July 16, 2025. /CFP

Editor's note: Xu Ying, a special commentator on current affairs for CGTN, is a Beijing-based international affairs commentator. The article reflects the author's opinions and not necessarily the views of CGTN.

As the Third China International Supply Chain Expo (CISCE) takes place in Beijing from July 16 to 20, 2025, global business executives and officials have voiced a collective need to reinforce supply chains through open markets, innovation, and multilateral engagement.

Foreign investment in China's artificial intelligence (AI) startup ecosystem is witnessing a notable resurgence in 2025. After a period of relative stagnation, international investors are once again showing confidence in early-stage ventures across the Chinese AI landscape. A combination of government policy support, technological breakthroughs and the growing potential for scalable commercial applications drives this renewed interest.

At the heart of this momentum is the Chinese government's strategic commitment to fostering AI as a national priority. Through targeted funds, supportive regulations and infrastructure investments, China has created a highly favorable environment for innovation. The launch of the 60 billion yuan ($8.2 billion) National AI Industry Investment Fund earlier this year marked a significant milestone, offering financial backing to promising startups while demonstrating the government's long-term dedication to technological self-sufficiency and industrial modernization. Local governments are also playing a proactive role by tailoring policy mechanisms to their regions' specific needs, helping foster a more diverse and comprehensive national AI ecosystem.

Alongside policy support, China's domestic AI companies are delivering notable technological advancements. Firms like DeepSeek have achieved global recognition for their breakthroughs in large language models and generative AI, drawing the attention of venture capital firms seeking exposure to cutting-edge research and development.

These achievements come at a time when Chinese developers are also showing increased ingenuity in overcoming challenges such as chip restrictions and limited access to international hardware. Rather than faltering, they have adapted through architectural innovation, improved efficiency and growing reliance on open-source technologies.

The commercial potential of China's AI sector is another key magnet for investors. From healthcare and e-commerce to autonomous vehicles and financial services, AI is rapidly becoming the core enabler of productivity and growth.

Morgan Stanley's researches estimate that the core AI industry in China could grow to $140 billion by 2030, while related sectors integrating AI, such as logistics, green energy and advertising, could collectively contribute over $1.4 trillion to the national economy. This scale and diversity of application present opportunities not only for local development but also for cross-border capital and technological collaboration.

The Third China International Supply Chain Expo opens at the China International Exhibition Center (Shunyi Hall) in Beijing, July 16, 2025. /CFP

International investors are showing particular interest in several high-growth segments within China's AI landscape. Generative AI technologies, especially those focused on image generation and virtual content, are attracting strong funding. Robotics, especially intelligent humanoid robots and automated systems, is another area drawing increasing attention. In the medical sector, AI-powered diagnostics and personalized healthcare platforms are witnessing robust foreign participation.

Semiconductor startups have also seen a sharp uptick in interest, as China pushes to build an independent chip ecosystem amid ongoing U.S. export controls. Parallel to this, China's cleantech AI applications in electric vehicles and renewable energy continue to see significant funding, reinforcing the alignment between environmental goals and digital innovation.

However, these promising developments are not without their complications. Regulatory scrutiny remains a reality in China's capital markets, especially for companies looking to go public or attract overseas partnerships. The domestic initial public offerings process can be complex.

Additionally, geopolitical tensions between China and some Western countries, particularly the United States, continue to cast uncertainty over the future of international technology cooperation. While Chinese startups are learning to adapt, the strategic calculus for global investors remains sensitive to shifts in diplomatic relations and trade policies.

Another challenge lies in the intense competition in the Chinese AI market. With a vast number of startups often targeting similar technological frontiers, not all ventures will succeed in differentiating themselves or achieving long-term profitability. Moreover, startups still face bureaucratic hurdles, infrastructure limitations and constraints on data access due to regulatory restrictions. These issues require careful navigation by both local entrepreneurs and international partners.

Despite these challenges, the fundamentals of China's AI development strategy remain strong. The country is making steady progress toward its goal of becoming a global leader in AI by 2030. Key national initiatives, such as the "Next Generation AI Development Plan" and the "AI Plus" frameworks, reflect a coordinated approach that combines research funding, infrastructure upgrades, talent cultivation and industrial application. These policies provide a clear roadmap that enhances investor confidence, both domestic and foreign.

While the U.S. currently leads in private AI investment, China is closing the gap quickly. In 2025, China's total AI investment is projected to reach $98 billion, with government support accounting for more than half of that total. Major internet firms and AI-driven unicorns are also playing a significant role in driving innovation forward.

Notably, foreign capital is finding its niche within China's generative AI and robotics spaces, particularly as the global industry begins to appreciate the value of applied research and scalable product design being developed in the Chinese context.

Regional development is also a crucial component of this story. While cities like Beijing and Shanghai remain at the forefront due to their advanced research ecosystems and funding networks, other regions are rapidly catching up. Provinces such as Guangdong, Jiangsu, Sichuan and Anhui are each leveraging their industrial strengths and policy initiatives to build regional AI hubs. Zhejiang is also developing rapidly. This decentralized yet coordinated approach to AI development ensures that innovation is not confined to a few elite zones but is integrated into the broader national economy.

The broader implications of this investment trend go beyond short-term venture cycles. It suggests a maturing AI ecosystem in China that is not only resilient in the face of external pressures but also increasingly attractive as a partner for global innovation.

Foreign investors are now finding ways to participate in China's AI growth story. As China continues its march toward AI leadership, foreign capital is likely to play a crucial role in building bridges, accelerating knowledge transfer and fostering technological pluralism. While the path ahead will require pragmatism and adaptability, the trajectory is clear: China's AI startups are not just recipients of investment, but engines of global technological transformation.

(If you want to contribute and have specific expertise, please contact us at opinions@cgtn.com. Follow @thouse_opinions on X, formerly Twitter, to discover the latest commentaries in the CGTN Opinion Section.)

阅读原文:https://news.cgtn.com/news/2025-07-20/Foreign-investment-surges-into-China-s-AI-startups-1Fa2TYOsp5C/p.html